If you’re living in Florida, and your family is struggling to afford groceries, you might have heard about a program that can help: the Supplemental Nutrition Assistance Program, or SNAP. Most people know it as “food stamps.” SNAP helps people with low incomes buy the food they need. But how do you know if you qualify? A big part of that is figuring out the income limit. This essay will break down what you need to know about the income limits for food stamps in Florida.

What’s the Simple Answer About the Income Limit?

The food stamp income limit in Florida depends on your household size. It’s also adjusted each year to keep up with the cost of living. **The income limit refers to the maximum amount of money your household can earn each month and still be eligible for food stamps.** That means the government looks at how much money everyone in your family who buys and prepares food together gets.

How Does Household Size Matter?

The income limits for food stamps change depending on how many people live in your household. This makes sense because a family of six needs more food than a single person. When the government looks at your household, they include anyone who buys and prepares meals together. That could be a family, roommates, or anyone else who shares the same kitchen and food budget.

Here’s an example to help you understand. Let’s say you live with your parents and siblings and you all buy and cook food together. Your household size would be the number of people in your entire family who share meals. On the other hand, if you live with roommates and you each buy and cook your own food, you would be considered separate households. The income limit changes for each family, so it’s very important.

Because the government wants to determine the right level of benefits for everyone, household size is very important. The government updates the rules from time to time, so you should always check the newest information. If you want to know more about it, here are some helpful points to consider:

- Household size is essential when you want to apply for benefits.

- Knowing the size of the group helps determine what kinds of services are offered.

- Having the right data allows services to be distributed fairly.

- It helps determine if a specific group should get benefits.

What Types of Income Are Counted?

When the government checks your income, they don’t just look at your paycheck. They count many different types of income to see if you meet the food stamp requirements. This can include things like money you earn from a job, unemployment benefits, Social Security, and even some kinds of financial assistance. It’s a complete picture of the money coming into your home.

This means if you are working part-time, getting support from the government, or receive money from other places, then it is probably counted. This helps make sure that those who need it most can get the benefits. The government wants to provide help to those who truly need it. Even though the idea can seem complicated, it is very important for the system to work properly.

There are some kinds of income that might not be counted. Here are some examples of common income types that usually *are* counted:

- Wages and salaries from a job

- Unemployment benefits

- Social Security and disability payments

- Pension and retirement income

- Alimony payments

It’s a good idea to find out all income types that are counted to be more prepared when you want to apply.

What are the Gross and Net Income Limits?

There are two different income limits you need to know about: gross income and net income. Gross income is the total amount of money your household earns *before* any deductions, like taxes or health insurance premiums, are taken out. Net income is what’s left *after* those deductions are subtracted. Both are important when the government is determining eligibility.

The government has to evaluate many things to determine your eligibility. Both gross and net income are used to see if you are eligible for benefits. Gross income can determine if you qualify to apply, while net income helps calculate the amount of benefits you can get. The difference between them is important to understand.

Here’s a simple breakdown:

| Income Type | Definition | Used For… |

|---|---|---|

| Gross Income | Total income *before* deductions | Determining initial eligibility |

| Net Income | Income *after* deductions | Calculating benefit amount |

If you want to figure out your eligibility, you have to look at both income types. Make sure you figure them out the right way!

Are There Any Deductions?

Yes! Thankfully, the government lets you deduct certain expenses from your gross income to arrive at your net income. This means that some of your expenses can lower the income number they use to determine if you qualify for food stamps and how much you’ll receive. These deductions help people who have higher expenses. It can make a big difference.

Deductions allow people to have a fair shot at getting the services they need. Here are some of the most common deductions that are permitted. You have to remember to keep track of your expenses if you want to get a deduction!

- A standard deduction for earned income (money you get from a job).

- Child care expenses needed for work or school.

- Medical expenses for people who are disabled or elderly.

- Certain housing costs (like rent or mortgage payments) that are higher than a certain amount.

When you are going to apply, make sure you have proof of all of your expenses. Things like bills, medical records, and childcare payment receipts will be helpful. If you can show what you spent and why you spent it, you are more likely to get the benefits you deserve.

How to Find the Current Income Limits?

The income limits for food stamps change every year, so the numbers you see today might not be the same next year. The best way to find the *most current* income limits is to go to the official Florida Department of Children and Families (DCF) website. That’s where they post the updated information. They often have clear tables and guides.

You can also contact your local DCF office or call their help line. They can give you accurate information and answer any questions you might have. You can also visit the United States Department of Agriculture (USDA) website. Here are some other things you can do:

- Look up the official Florida DCF website.

- Call the local office or contact their help line.

- Visit a local community center or a social services office.

- Search online for recent news.

Remember that it is important to find the right information so you can apply for the benefits that are right for you.

What Happens After You Apply?

After you apply for food stamps, the Florida DCF will review your application. They will ask for proof of your income, your address, and how many people live in your household. You might need to go for an interview so they can ask you questions to see if you qualify. It’s like a test, but a lot less scary. They want to see if you need their help.

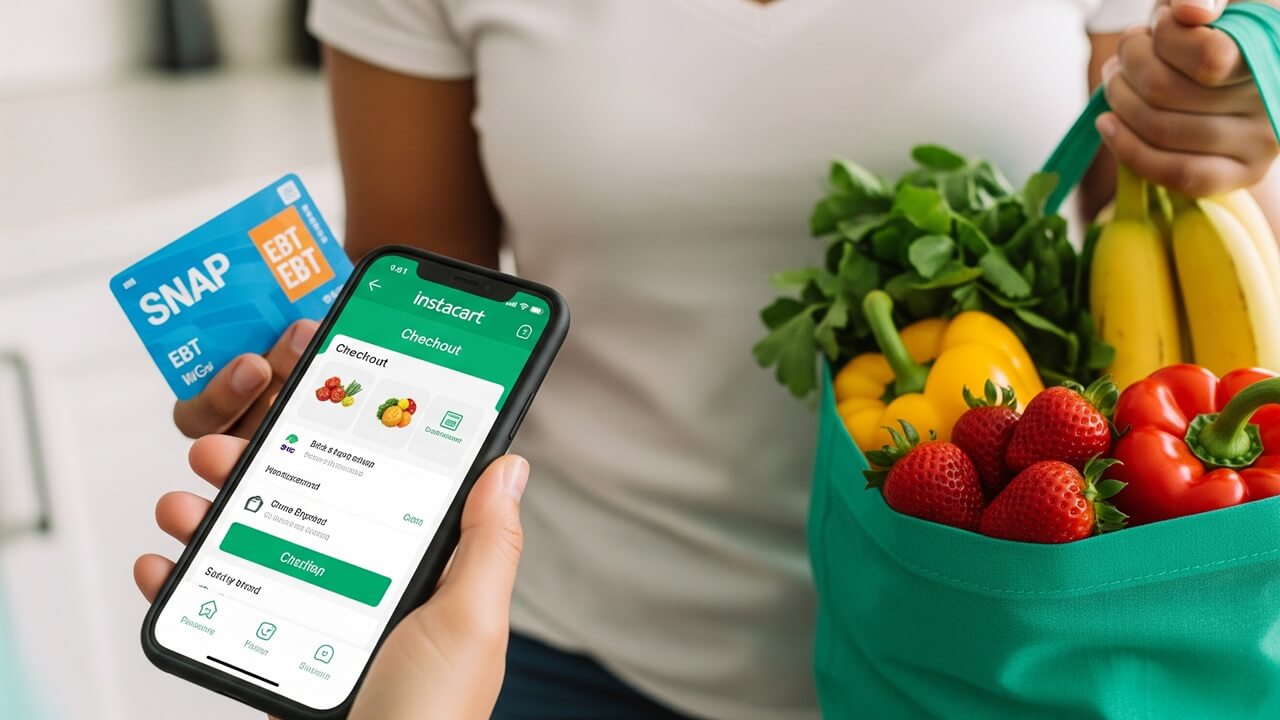

If the government decides you are qualified, you will receive your food stamps in the form of an EBT (Electronic Benefit Transfer) card. This is a special card you can use like a debit card to buy groceries at most stores. They will tell you how much money you get each month. If you are approved, then you will receive the food stamp benefits.

Here are some things that will happen during and after the application process:

- Fill out the application.

- Submit any documents that are needed, like proof of income and address.

- There might be an interview.

- Get the EBT card if you are approved.

- Use the card to buy groceries.

You have to keep your information current by regularly renewing your benefits. Make sure you follow all rules so you can keep the benefits you deserve.

Conclusion

Understanding the food stamp income limits in Florida is important if you are trying to figure out if you and your family qualify for help with groceries. Knowing about household size, different types of income, and deductions will help you understand your eligibility. Remember to always check the official Florida DCF website or contact your local office for the latest, most up-to-date information. By knowing the rules and the requirements, you can take the first step toward getting the support you need to put food on the table.